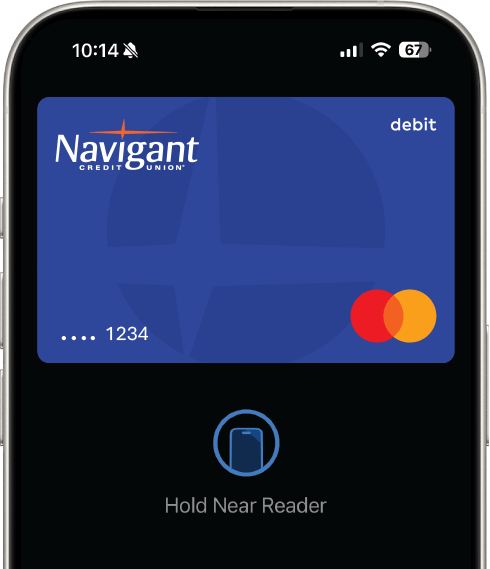

We know your life is busy. That’s why we want to help by simplifying things wherever we can with products like our Mastercard® Debit Card that saves you the hassle of carrying cash or writing checks. From the added security of our EMV chip-enabled cards, to our Card Controls that allows you to manage your debit cards through your mobile device, we’re on a mission to make your life more convenient.

A Safe and Secure Way to Pay

For a faster, easier way to pay, just hold your contactless Mastercard® card over any reader where you see this sign.

Use them fee-free, 24/7

As a Member, you can use our ATMs, 24/7 fee, free.

Click here to view our branch locations, including our ATM on the Bryant University campus (MAC) in Smithfield, RI.

Don’t worry if you’re away from home.

Our partnership with Rhode Island Credit Union ATM Network allows our members to make withdrawals from their ATMs, fee-free. Click for locations in RI.

Security at your fingertips

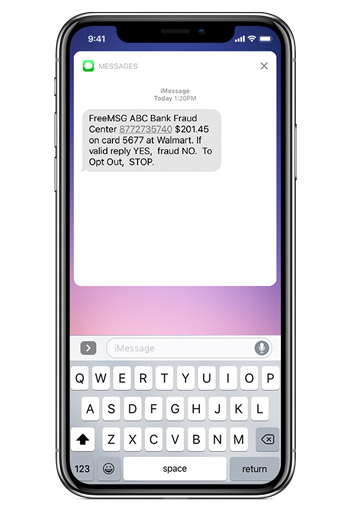

We are committed to providing our members with the most advanced fraud protection solutions available. Fraud Protection through interactive text alerts will help stop card fraud by alerting you as soon as suspicious activity is detected.

Members are automatically enrolled in this free service. The new text messaging feature is an alert that members are enrolled in for immediate notification to their mobile phone number listed on their account.

How it works:

Bringing added security to your payments

All of our credit and debit cards are embedded with a tiny microchip that does big things. EMV cards hold your personal data in this secure microchip—rather than the traditional magnetic stripe–making it virtually fraud-proof when you insert it into a card terminal to pay.

Peace of mind even after hours

Please call 401-233-4700 (select option 3) to conduct the following transactions on your Debit Card:

New Members: If you do not have a checking account please contact us about opening your account or open an account online and purchase a “Your Journey” Debit Card today.

Current Members: If you already have a checking account with us you can order a “Your Journey” Debit Card online whenever you are ready.

Your checking account will be assessed a processing fee of $10.00.

Click here to design your card with your desktop computer.

Click here to design a card with your mobile device.

Please note that “Your Journey” personalized debit cards have a different debit card number than the initial debit card provided to you by Navigant Credit Union. Existing automatic payments setup on a debit card would have to be updated to the new personalized debit card number within 60 days to avoid any payment disruptions.

Image Requirements for Personalized Digital printed Visa Cards Images that contain any of the following will not be accepted:

Now all you need is your Smartphone and your Navigant Credit Union Mastercard® to make checkouts quick and easy. Just set up Android Pay, Samsung Pay or Apple Pay and turn your phone into your own digital wallet.

Life moves quickly, and unexpected expenses can pop up and lead to accidental overdrafts. At Navigant Credit Union, we do our best to work with our members to solve those problems so that you can continue moving along your financial journey.

The choice is yours. Consider these ways to cover overdrafts:

Overdraft Protection services apply to all transactions and may help prevent overdrafts by automatically transferring funds to your checking account from another account, or line of credit you may have at Navigant Credit Union for a fee or finance charge. Please note that overdraft lines of credit are subject to credit approval.

Overdraft Privilege allows you to overdraw your account up to the disclosed limit for a fee in order to pay a transaction. Even if you have overdraft protection, Overdraft Privilege is still available as secondary coverage if the other protection source is exhausted.

Click here for the full Overdraft Privilege disclosure.

| Transactions Covered with Overdraft Privilege | Standard Coverage (No action required) | Extended Coverage (Your consent required on consumer accounts)* |

|---|---|---|

| Checks | X | X |

| ACH - Automatic Debits | X | X |

| Recurring Debit Card Payments | X | X |

| Online Bill Pay Items | X | X |

| Teller Window Transactions | X | X |

| ATM Withdrawals | X* | |

| Everyday Debit Card Transactions | X* |

*If you choose Extended Coverage, ATM withdrawals and everyday debit card transactions will be included with the transactions listed under Standard Coverage.

You can discontinue the Overdraft Privilege in its entirety or opt-out of Extended Coverage by completing this form or contacting us at 401-233-4700.

1. Call us at 401-233-4700, email us at [email protected], or come by a branch to sign up or apply for these services;

2. subject to credit approval.

*If you choose Extended Coverage, ATM withdrawals and everyday debit card transactions will be included with the transactions listed under Standard Coverage.

PLEASE CONTACT US AT 401-233-4700 (at least 24 hours before you leave)

Travelers names, depart/return dates, where you’re traveling to, and the best contact phone number to reach you while you are traveling.

We take the security of our cardholders very seriously and employ sophisticated systems to identify potentially fraudulent transactions on your ATM or debit card. Due to fraud restrictions for certain countries, let us know when and where you will be traveling in order to avoid declined transactions or fraud alert calls for out-of-the-ordinary transactions. This is VERY important for international travelers.

In addition, please note:

We always recommend carrying at least two (2) payment products in addition to cash. Navigant Credit Union offers a full line of credit cards. Please visit any branch location for more information.

Enjoy your journey!

Holiday Hours: Please note our adjusted hours this holiday season.

Dec 24th (Christmas Eve): Closing at 1:00 PM, Dec 25th (Christmas Day): Closed, Dec 31st (New Year’s Eve): Closing at 2:00 PM, Jan 1st (New Year’s Day): Closed