MOBILE BANKING

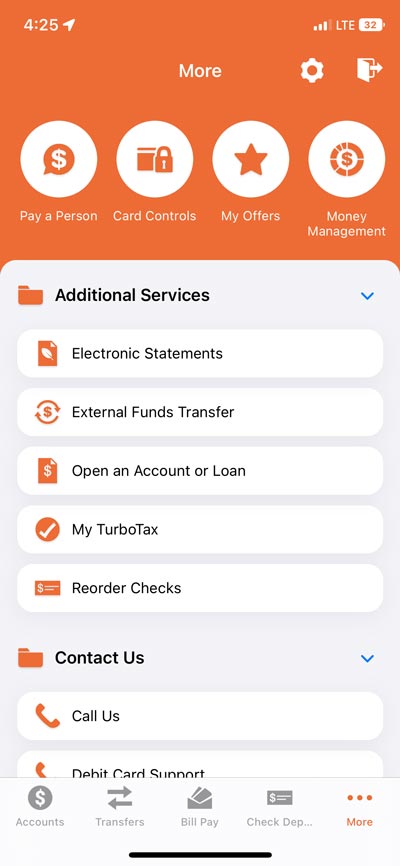

You’re busier than ever. Just because you’re on the go doesn’t mean you can’t stay connected to your finances. With our free mobile banking app for iPhone®, iPad® and Android™, you can view accounts, transfer money, pay bills, locate branches, and find ATMs, anytime, anywhere. Plus, you can access Pay-A-Person through mobile banking to do things like send money to your babysitter or pay your roommate the $50 you owe him, by simply emailing or texting.

More Details

Keep your money even closer

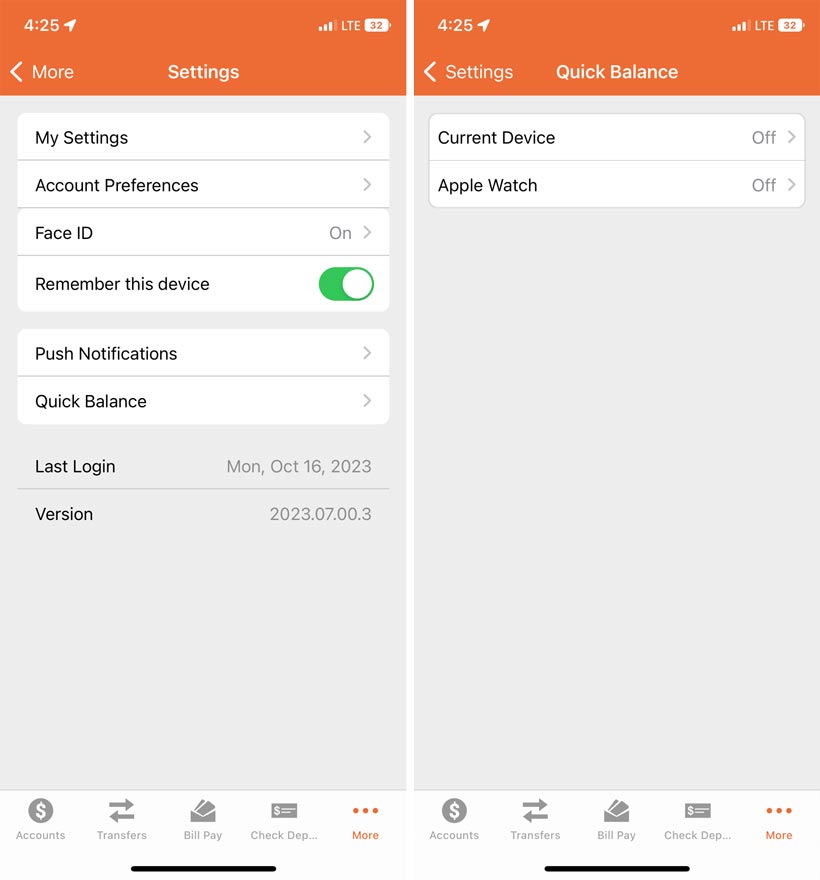

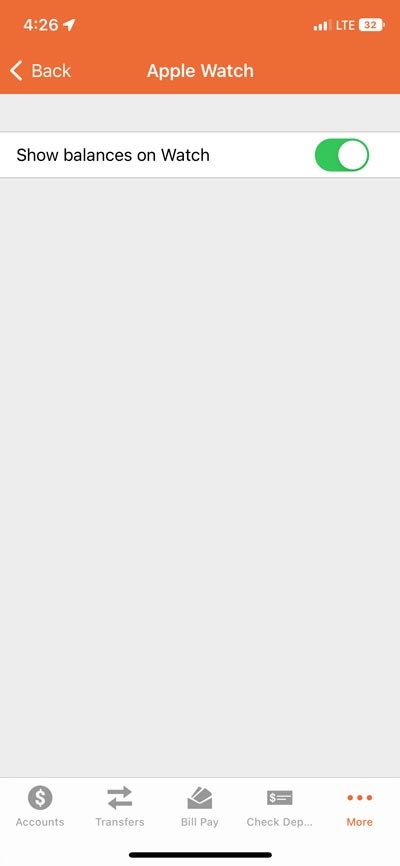

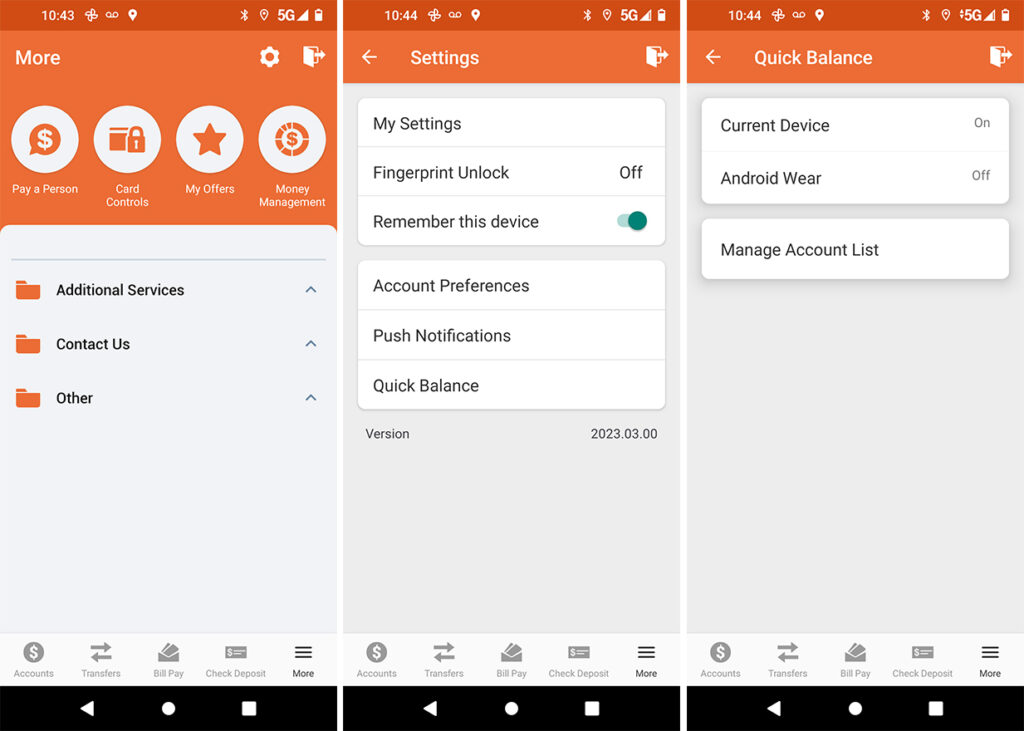

This gives new meaning to the old saying, “time is money.” Now you can use your Apple or Android smartwatch to manage your money. With the Apple Watch or Android Wear on your wrist, you’ll be able to:

Standard Android Wear operating systems are supported.

Apple Watch

Apple Watch and iTunes are registered trademarks of Apple Inc.

Android Wear

Click, Tap, Deposit

Don’t have time to make a trip to the bank? No problem. With our Navigant Credit Union Mobile Banking app for your iPhone®, Android™ or iPad® devices, you can deposit checks anytime, from anywhere.

Mobile Deposit Overview

Free, easy and secure to use

Manage your financial life on your terms with our Text Banking. It is free*, secure and gives you the freedom to bank anytime and anywhere.

Use Text Banking to:

*Message and data rates may apply from your wireless carrier.

Our Mastercard Debit Card takes away the need to always have cash on hand and gives you the convenience of being able to skip the check writing when you make a purchase. Funds are withdrawn directly from your assigned checking account.

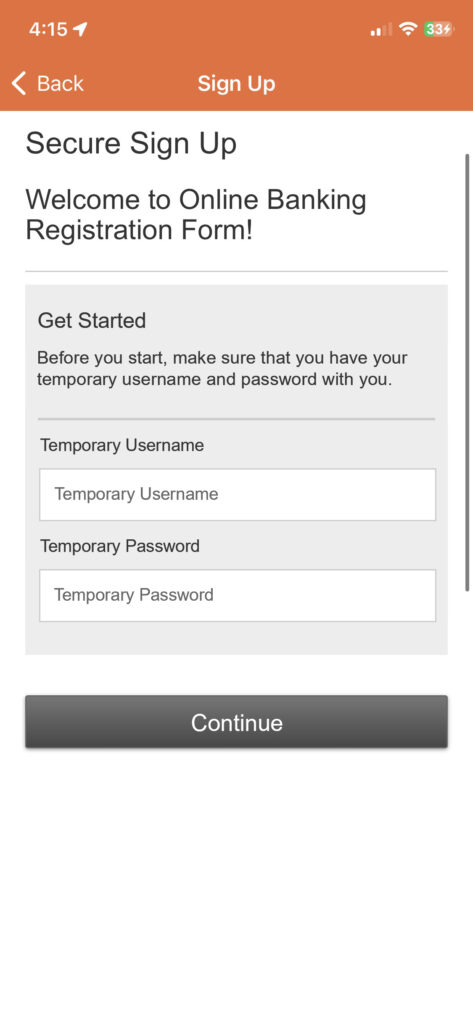

Enter initial temporary User Name (Social Security Number, no dashes) and Password (4-digits selected at account opening), then click “Continue”.

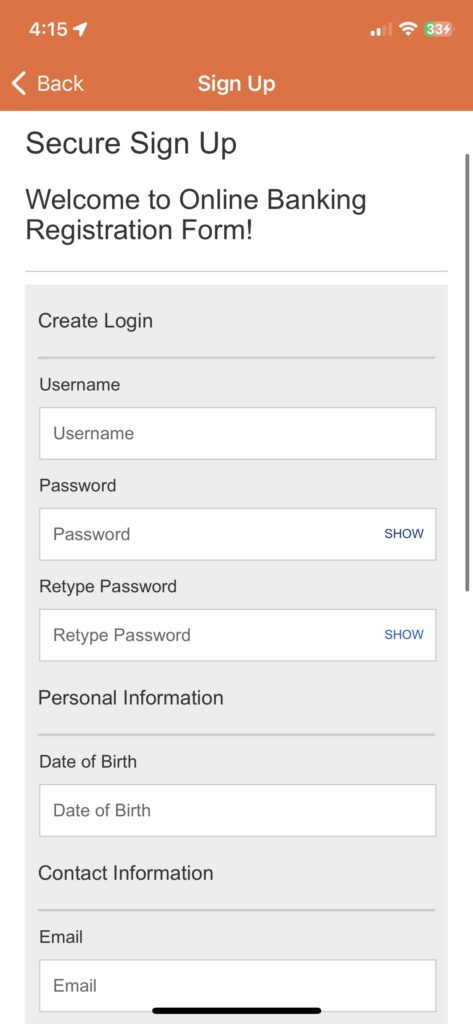

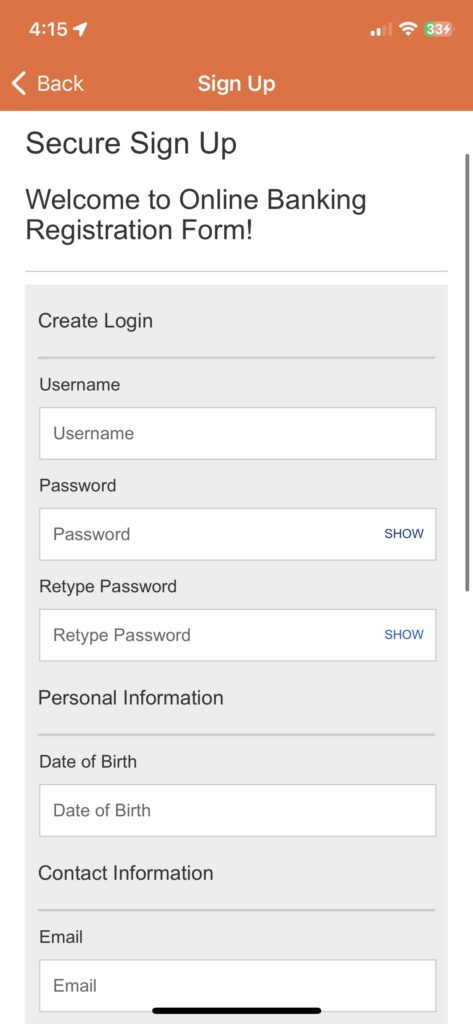

Create a unique, new username and new, strong password.

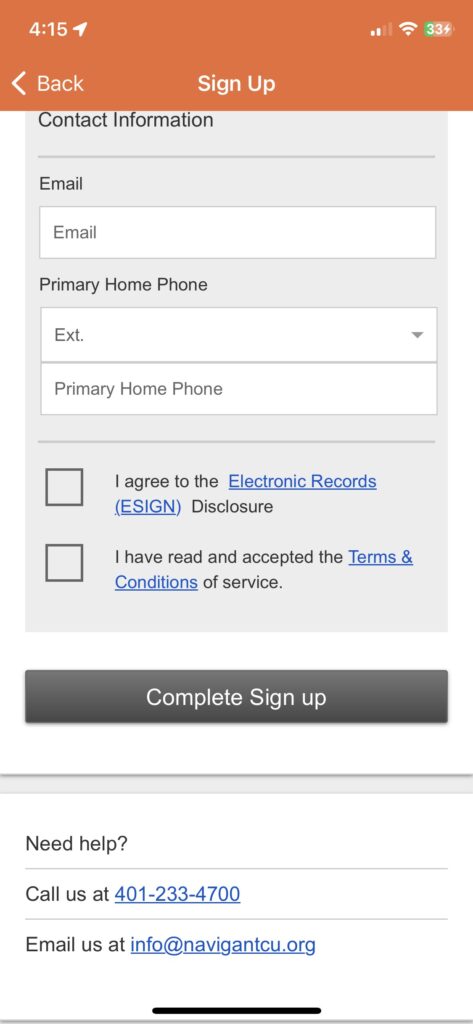

Enter date of birth (MM/DD/YYYY), email address and primary contact phone number.

Agree to Electronic Record (ESIGN) disclosure and Terms & Conditions of service and click “Complete sign up”.

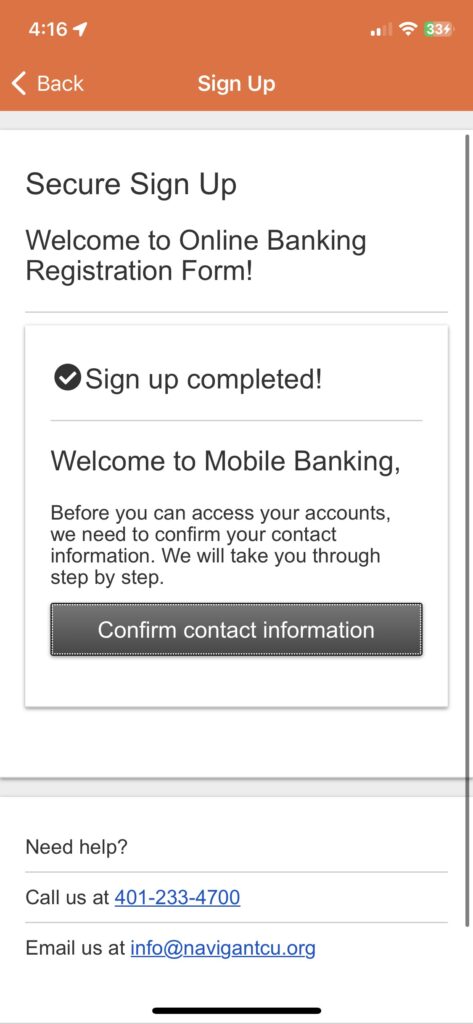

Click the “Confirm contact information” button.

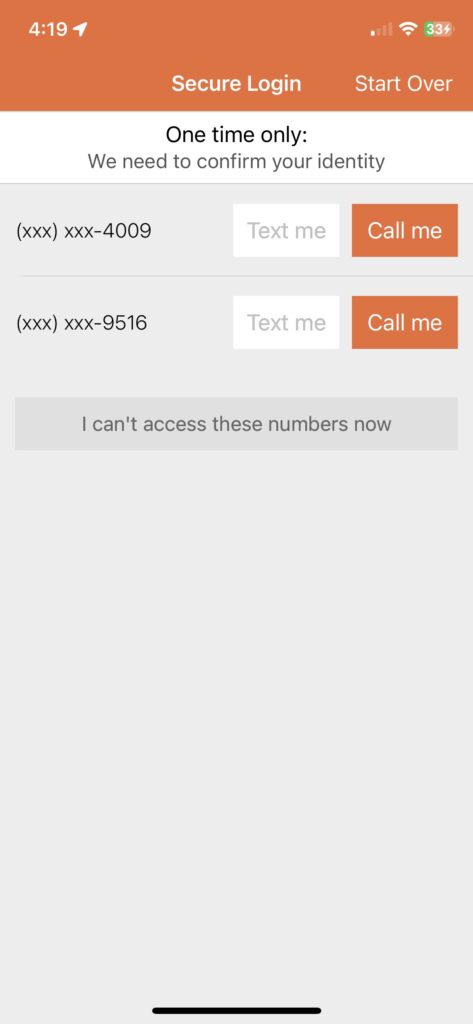

Click “Call Me”.

Answer incoming call.

Press 1 to allow access.

Press 3 to deny.

Press # to repeat.

This is a courtesy alert to let you know that the link you just clicked will connect you to a third-party website in a new browser window. We are obligated to tell you that this third-party website is not owned or operated by Navigant Credit Union, that Navigant Credit Union is not responsible for the content of this site and does not represent you or the third party if you enter into a transaction. Privacy and security policies may differ from those of Navigant Credit Union. If you continue, it will be easy to navigate back to the Navigant Credit Union website by closing the partner website window.

BRANCH UPDATE: Our Central Falls branch location will be closed on Wednesday (2/25) and the Chepachet branch location will have a delayed opening of noon. Thank you for your patience as everything gets restored.